Note: This analysis was initially shared in The Weekly Stable (Vol 17): The Commoditization of Stablecoin Issuance on May 15th 2025. Sign up to the Weekly Stable newsletter for stablecoin news and analysis.

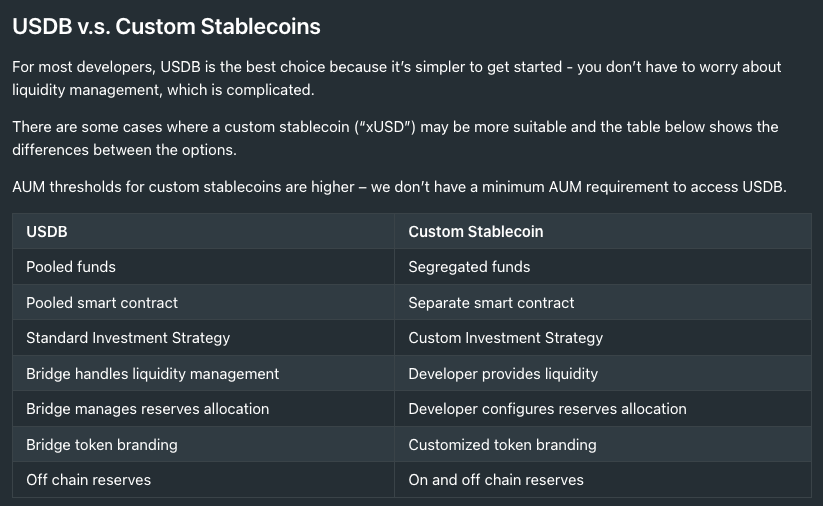

Bridge’s launch of Stablecoin issuance APIs was drowned in the sea of announcements last week but are worth double clicking on. They allow developers to issue USDB, its internal stablecoin, or spin up white-labeled stablecoins backed 1:1 by USDB. Developers keep most of the yield, and conversions to and from USDC are instant and free.

It is a clean API-first model, but not a new one. Brale already offers this ability across multiple chains. M^0 has enabled over $200M in white-labeled stablecoins like USDN and UsualM. What Bridge brings is distribution. Backed by Stripe and already powering products like stablecoin financial accounts, Bridge could bring this model to a much broader developer base.

More importantly, this launch signals a broader shift: stablecoin issuance is becoming commoditized infrastructure. It is no longer a high-friction product. It is a low-friction primitive. As it becomes easier to launch, operate, and shut down a stablecoin, more developers will use them to solve narrow problems: internal treasury flows, user rewards, marketplace tokens, and closed-loop payments.

Distribution remains the critical challenge, both for the platforms like Bridge and Brale, and for the developers issuing stablecoins. Closed ecosystems, where developers control the user base, are the most obvious fit. In these environments, developers can abstract away minting, burning, and conversion, and capture yield in the process. Open systems are harder. Liquidity and acceptance still favor incumbents like USDC.

But that may change. As zero-fee, yield-bearing stablecoins become the default, the baseline expectation shifts. Wallets and apps have a strong incentive to help users move from non-yielding USDC into more rewarding alternatives. This puts pressure on USDC’s position as the neutral, default stablecoin, especially when users care more about rewards than brand.

We are entering a “why not” phase of stablecoins. If issuance is simple, yield is shared, and switching costs are low, the question becomes why a developer wouldn’t try. Most of these tokens will be short-lived. Some will power meaningful ecosystems. All will reset what developers expect from stablecoin infrastructure.

Bridge’s launch is not about a new feature. It is about lowering the barrier to entry. And when the barrier drops, volume follows.