Can Circle Build the Visa of Stablecoins? Inside the Circle Payments Network

A deep dive into CPN, why it matters, and the battle to own cross-border stablecoin payments.

1. Introduction

Circle just launched the Circle Payments Network (CPN), and it’s a big deal. It marks Circle’s clear intention to evolve their business model and positions the company as not just a stablecoin issuer, but also a payments network operator (a Visa/SWIFT hybrid). The launch has sparked industry-wide debate because it represents: (1) a strategic shift for Circle, (2) a new model for stablecoin-powered payments, and (3) a competitive threat to many ecosystem players.

This piece unpacks what CPN is, why it matters, what could determine its success (or failure), and what it means for the broader payments and stablecoin ecosystem.

2. The Problem

Most people think of payments as just value transfer. But in reality, payments are far more than that. They involve clearing (who owes who what), data sharing for compliance (KYC, AML, sanctions), netting, reconciliation and then settlement (that’s the value transfer part). If there’s an FX element, add quote execution, liquidity, confirmation, and more reconciliation. For each intermediary add more clearing, more data sharing, more reconciliation… you get the picture.

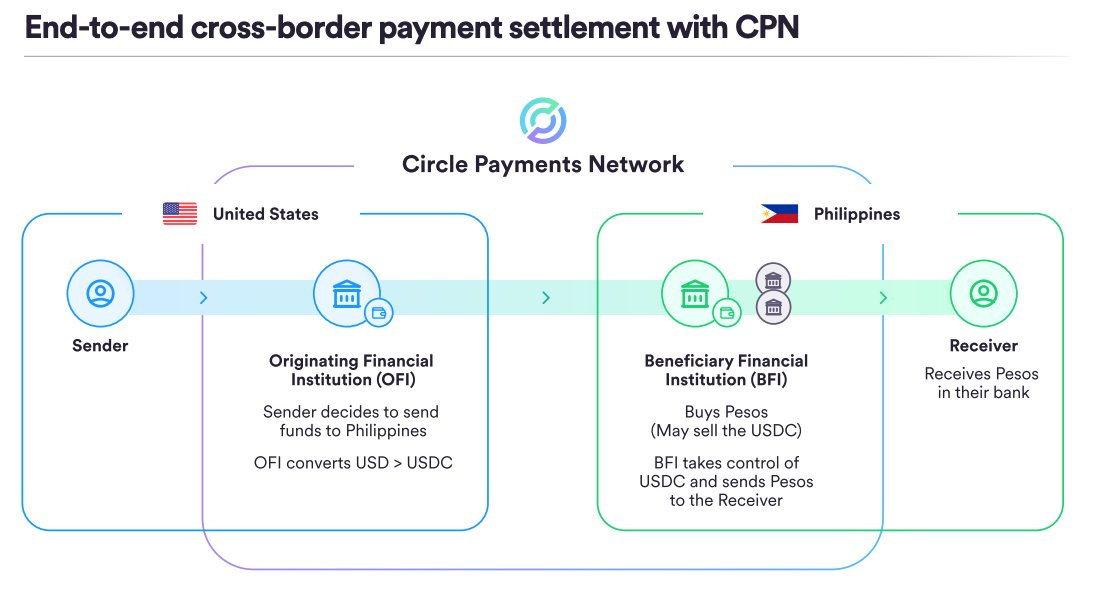

Theoretically, stablecoins are cheaper, faster, better for cross-border payments because (1) you can remove intermediaries whose low tech infrastructure slows down the process to handle these steps and (2) the value transfer is instant and 24/7. The sender onramps fiat to a stablecoin, sends the stablecoin to the receiving entity who off ramps to local fiat and makes the last mile payment. The entire process can happen in minutes, not days.

But to make stablecoins useful for international payments, companies need to integrate with on/off ramps in multiple jurisdictions. Each integration can involve different APIs, compliance procedures, licensing requirements, and liquidity constraints. Building out such infrastructure, corridor by corridor, is both costly and slow.

Even with access to one corridor, to be reliable at scale requires working with multiple partners to ensure redundancy and best pricing. Routing logic and onboarding costs further complicate the buildout. Building out these networks is possible but takes time and effort to scale (props to firms like Keyrail, Triple-A, Mural, and Nilos, who already support multiple corridors).

No single cross border orchestrator is connected to all the corridors, and they can have different requirements for compliance information. For a user of these services (e.g. a Remittance company) they by default have to connect to multiple networks and manage routing. The dream of real-time, low-cost cross-border stablecoin payments is hampered by coordination, compliance, and infrastructure complexity.

If only there was a way to get access to all these off ramps through a single integration, one set of standards for compliance, and best pricing…

3. How does CPN solve this?

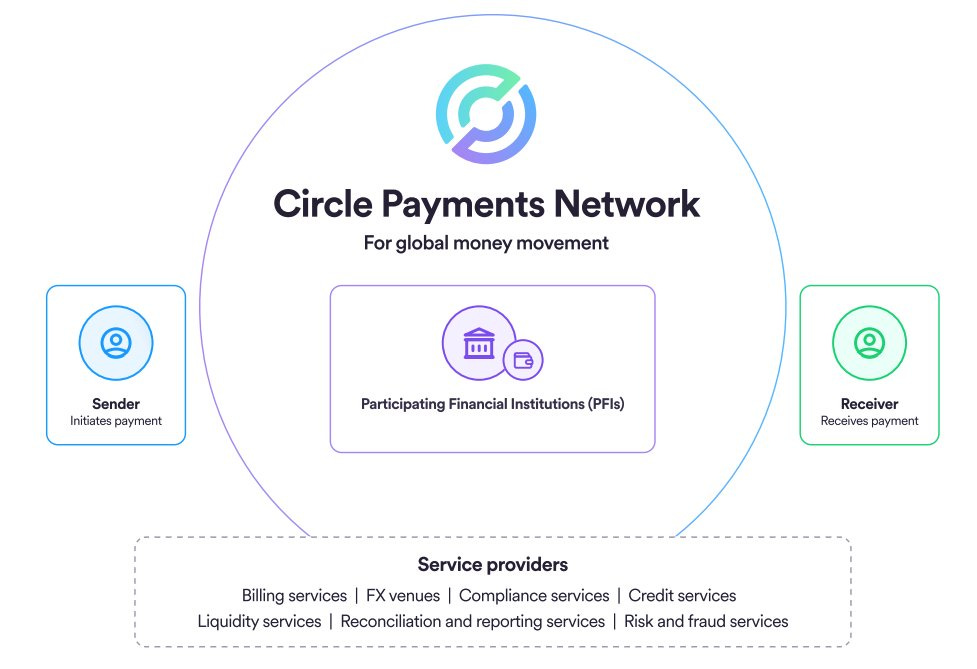

CPN solves this complexity by offering a protocol layer that connects vetted Participating Financial Institutions (PFIs) globally under a common compliance and messaging framework.

Rather than requiring businesses to integrate with dozens of local players, CPN provides a single integration point. Circle handles credentialing, compliance, and standardization of how institutions share payment and KYC data. It uses off-chain APIs to orchestrate payments and then settles on-chain using USDC or EURC (and are open to other stablecoins that meet their standards).

They don’t handle the funds, but they do facilitate the off chain and on-chain messaging (and ensure they get paid). The fee model is as follows: there's a charge for payouts (to compensate receiving PFIs for local disbursement), a spread on FX conversions (to cover liquidity and conversion risk), and a variable network fee (tiered by country group) to fund compliance, infrastructure, and development. This variable network fee seems conceptually similar to the 10-15bps network fee charged by Visa and Mastercard for running the network. They can also generate revenue from monetizing value-added services such as fraud detection, escrow, and a third party services marketplace.

In summary, it’s a trust and coordination network. It’s smart and seems logically sound. This model isn’t new however, and we’ve seen similar attempts before. CPN follows a long line of trust-and-coordination protocols including tbDEX, UMA, and Borderless.xyz, all of which aim to abstract integration complexity and enable regulated participants to interoperate across asset rails. (See details in the appendix).

So why is this a big deal?

4. Why It Matters

Blockchain powered Payment Networks will redefine global money movement While CPN isn’t the first, it’s distinct in that it’s operated by Circle, an established, profitable and well capitalized issuer with existing global distribution through USDC and 1000s of existing integrations. Payment networks are great on paper, but like other multi-sided marketplaces, they require scale to work (the cold start problem) and solving this requires near flawless execution. Circle’s brand, capital and regulatory connections put them in a relatively strong position to pull this off.

Strategic evolution for Circle This launch represents an entirely different business model for Circle, from reserve-interest revenue to transactional revenue. By inserting itself into the payments flow, Circle can now monetize cross-border stablecoin activity via network and other fees. This is critical as Circle approaches IPO and needs to tell a story of revenue diversification beyond rate sensitive interest income.

Big implications for the ecosystem This move puts Circle in direct competition with other payment networks, and to an extent orchestrators. More on this below.

5. What Circle needs to overcome to be successful

A scaled payment network is elegant in theory: high volumes flow from senders to receivers through a single integration, with competitive pricing, seamless compliance, and reputable, vetted institutions on all sides. But building this in practice is enormously difficult. For CPN to succeed, Circle must overcome several structural and strategic hurdles, many of which compound on each other.

1. Pricing & Liquidity: The Cold Start Problem

Payments is a volume and take-rate game, and CPN faces the classic cold start problem. To offer competitive pricing, the network needs a critical mass of receiving PFIs with strong local liquidity. But PFIs will only stick around if there’s consistent volume to justify the operational and compliance overhead of maintaining connectivity.

At the same time, large senders may already have access to good pricing through optimized routes. Convincing them to adopt CPN will require clear advantages on price and/or speed, and even then, coordinating both senders and receivers across corridors is a major lift

Liquidity fragmentation further complicates this. The best FX pricing often exists in fiat or other stablecoins like USDT, particularly in emerging markets, so Circle may be at a disadvantage from the start for price sensitive players. It’s possible CPN gains early traction in high-speed, price-insensitive use cases before expanding.

2. Standardized, Scalable Compliance

One of CPN’s selling points is institutional-grade compliance through standardized information sharing (e.g. Travel Rule, KYC/KYB data). But turning that into operational reality requires harmonizing legal, technical, and process standards across dozens of jurisdictions. Managing liability and trust and ensuring that PFIs feel safe relying on counterparty data and vetting is much harder than it sounds, and subtle differences in interpretation or enforcement can derail corridor-level interoperability.

3. Technical Integration and Product Maturity

Ensuring that the orchestration layer (API interfaces, quote engines, routing logic, smart contract protocols) works flawlessly across chains, tokens, institutions, and use cases is a non-trivial technical challenge. In addition, PFIs require integration support which represents a significant solutions consulting burden.

4. Coordination and Governance Complexity

Governing a multi-jurisdictional, multi-stakeholder network is inherently operationally intensive. This involves setting and enforcing network rules, managing credentialing, handling disputes, maintaining SLAs, and iterating standards over time.

Success requires focus

These problems aren’t intractable and Circle has a lot of the ingredients to get this done. However, executing this requires tremendous focus.

Circle is entering the public spotlight as it approaches IPO. Leadership is already managing profitability pressures, evolving U.S. regulatory expectations, and macroeconomic uncertainty (e.g. rate volatility). In that environment, prioritizing the rollout, expansion, and governance of a centralized payments network is a major strategic bet, and one that needs to sit high on the executive stack to succeed.

6. Ecosystem Implications

CPN is obviously great for Payment companies, fintechs and PSP who get global payouts with one integration. This is ultimately good for end user individuals and businesses. However the effects on other key ecosystem players are somewhat mixed:

Orchestrators (e.g. Bridge):

For orchestrators that connect PSPs to multiple on/off ramps, CPN presents both competition and opportunity. It may erode their moat around corridor stitching, but doesn't eliminate differentiation entirely, especially for those offering value-added services like named accounts, cards, or fiat/crypto liquidity. In fact, joining CPN can expand corridor access and help scale faster, allowing orchestrators to focus on higher-margin or specialized services. BVNK, Conduit, and Nilos have already announced participation, signaling that integration is seen more as an accelerant than a threat.

Stablecoin issuers:

CPN introduces strategic questions for other stablecoin issuers. Regulated players like Paxos, or soon, Fidelity, may seek inclusion in corridors where they offer strong liquidity. However, it’s likely Circle will prioritize USDC and EURC, given the incentives to reinforce its own asset ecosystem.

Given USDT regulatory standing, support for USDT is very unlikely, despite its dominant liquidity in many emerging markets where stablecoin adoption is growing fastest. Given Tether’s existing network effects, they may not need to do anything at all, but they could use their financial resources to respond by supporting alternative payment networks or backing their own competing infrastructure, such as a new network built on Plasma, a dedicated stablecoin settlement blockchain backed by Tether.

Other payment networks (e.g. Borderless, Ripple, UMA etc):

While CPN is a direct competitor, it also validates the coordination layer model pioneered by players like Borderless. Circle’s brand and resources may grow the pie for everyone, especially by educating the market and regulators, and driving integrations and liquidity.

In addition, Circle most likely will push for adoption of its own assets USDC/EURC, which may push demand toward networks that welcome all stablecoins equally such as Borderless or any network that Tether may build on top of Plasma.

7. Conclusion & Key Questions

CPN is a bold bet by Circle to move up the stack, from issuer to protocol operator. It solves many of the hard infrastructure and coordination problems that have blocked mainstream stablecoin payments. But success depends on how well they can execute on the vision.

Key questions to watch:

Can CPN attract enough PFIs for liquidity and pricing to be compelling?

Will there be sufficient volume to satisfy these PFIs?

Will Circle support non-USDC assets meaningfully, or will existing USDT adoption favor competing networks?

How will other orchestrators integrate or compete?

Will regulators endorse the model as a compliant standard?

If CPN works, it could be the foundation of a global, always-on, programmable payments network. If it doesn’t, it will have been an honorable attempt that marked an important inflection point in the evolution of stablecoin infrastructure.

Circle has entered the arena.

Appendix

The tbDEX protocol is from the TBD team at Block. Their whitepaper describes it as a protocol for exchanging assets which aims to solve the difficulties in accessing on/off-ramps between traditional and decentralized systems without the need for centralized exchanges. It facilitates this by providing a framework for social trust using Decentralized Identifiers, Verifiable Credentials, and Participating Financial Institutions (PFIs). A decentralized and open trust and coordination network. The protocol doesn’t charge a fee, which isn’t necessarily a good thing as fees drive investment and provide incentive to grow the network. This didn’t get off the ground as its decentralised ID model had regulatory and compliance challenges. Block has since streamline the firm and unfortunately this team was shut down).

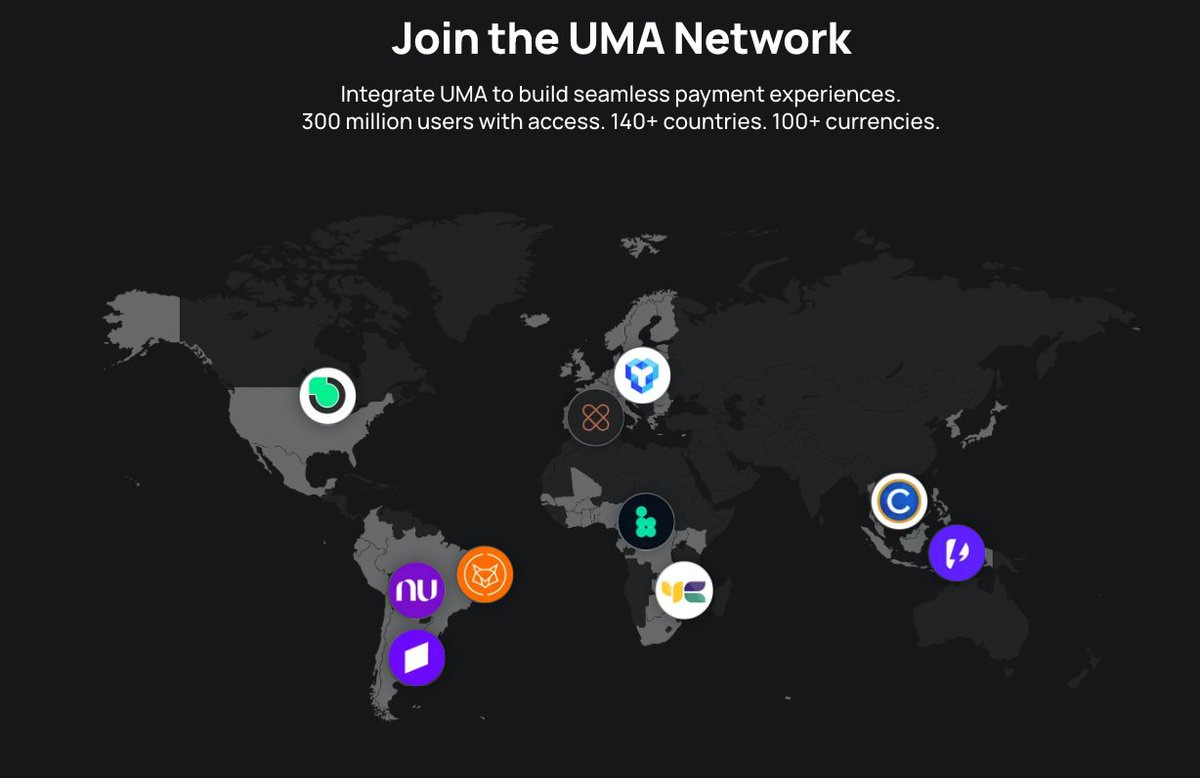

The UMA Protocol is a similar network built by the team at Lightspark, it connects vetted financial institutions and uses Bitcoin on the Lightning Network as the settlement asset and rail for near instant settlement times. It’s live today connecting 300 million users with access, 140+ countries and 100+ currencies through several partners including ZeroHash, Nubank, YellowCard, Xapo, Coins.ph and more.

More recently you have Borderless.xyz that is building a trust and coordination network for stablecoins specifically where you can access 10 regulated PFI (and counting), unlocking 51 countries, 24 currencies, and 32 payment methods in a single streamlined integration.

Ripple Payments: Ripple has already processed $70B in volume via their somewhat closed payments network Ripple Payments. They, too, promote their own stablecoin (RLUSD) although they accept others such as USDT for funding.