First Stripe, now MoonPay: What's Your Stablecoin M&A Strategy?

A framework for analyzing Stablecoin M&A opportunities

Why Are Companies Acquiring Stablecoin Infrastructure?

If you've found yourself wondering why MoonPay recently acquired Iron.xyz or why Stripe spent $1.1B acquiring Bridge, and who's likely next, you're asking the right questions. These acquisitions are signals that stablecoins are rapidly reshaping financial services, creating both massive opportunities and disruptive threats for incumbent players. Companies are racing to either seize the opportunity or proactively prevent disruption.

TLDR: M&A is the fastest way to acquire niche expertise, integrate advanced capabilities, and accelerate market entry in stablecoin infrastructure. If your business strategy relies in part on first mover advantage and you have conviction, consider M&A as a tool to accelerate your roadmap.

The Stablecoin Opportunity: Why Is It So Attractive?

Stablecoins represent a fundamental transformation of financial infrastructure, and are reshaping how businesses and consumers transact globally. They enable instant, low-cost cross-border payments, efficient treasury management, and the ability for consumers and businesses to hold US dollars globally. For deeper exploration, I highly recommend the comprehensive analyses from Matt Brown, a16z, Fintech Takes and Fintech Brainfood).

This transformation creates profound disruption but equally compelling opportunities. Though we’re early in a long adoption curve, smart companies are already positioning themselves strategically and banking/fintech leaders must ask themselves: How should we play in this evolving landscape?

Why Did Stripe Acquire Bridge and MoonPay Acquire Iron?

The recent frenzy in interest over stablecoins arguably began following the announcement of Stripe’s acquisition of Bridge in October of last year.

Stripe acquired Bridge to solve payment cost and efficiency problems, enhance global reach and become the leading developer platform for stablecoin payments.

MoonPay acquired Iron.xyz to enhance its offering for enterprise clients, and position itself as a leader in the evolving world of digital payments.

In both cases the companies acquired key capabilities that were complementary to their existing strengths and could be leveraged within their existing business:

Stripe:

Already processes $1.4 trillion annually and deeply understands the pain points of cross-border payments for business of all sizes

Sees stablecoins as solving critical cost, efficiency and settlement problems and for expanding global reach.

Bridge is a developer first API platform for stablecoins enabling Fiat<>Stablecoin orchestration.

With Bridge, Stripe intends to become the leading platform enabling enterprises and developers to integrate stablecoin payments.

Alignment with strengths: Developer-first approach, immense customer base with cross border payment flows

MoonPay:

Already one of the largest crypto on-ramps globally, they facilitate crypto purchases using fiat and processes crypto payments on behalf of merchants. They support 180 countries, serve 30 million users and have processed $8B of crypto payments to date.

Stablecoin payments is a logical extension of their existing services. By acquiring Iron, they can offer services such as multi-currency treasuries, instant cross-border payments and yield-bearing accounts to their existing business customers.

This aligns with MoonPay’s broader strategy to grow its enterprise offerings, building on its earlier acquisition of Helio, a Solana-based payment processor.

Alignment with strengths: Existing global fiat connections, large merchant network.

Stablecoin Payments M&A Framework

Clearly it’s time to consider updating your strategy, but how? Here’s my suggested framework to break it down:

Develop a POV on the new opportunities unlocked by stablecoins

Identify required capabilities

Understand the market landscape and identify the key players

Buy vs Build Analysis

Step 1: Develop a POV on the new opportunities unlocked by stablecoins

Key Questions

What are the trends? What might the world look like in 2030?

How can your customer problems be solved differently? How does this impact your existing business and competitive positioning?

What role will your company play?

Stablecoins can be better, but it depends on the target user, their use case and the existing alternatives. This has been written about extensively (see Fintech Takes and Fintech Brainfood) so I’ll just summarize to the below (if you’re interested in a deeper dive into use cases let me know):

Properties: Fast settlement, decentralized and permissionless, 24/7/365, low cost value transfers, programmable

Use cases: Global dollar access, simplify complex payments (cross border, treasury), embedded finance

Big gainers: Consumers and businesses. Fintechs who can adapt rapidly. US Government (arguably)

Big losers: Banks/fintechs who fail to adapt to the presence of new choices for their customers where switching costs are low

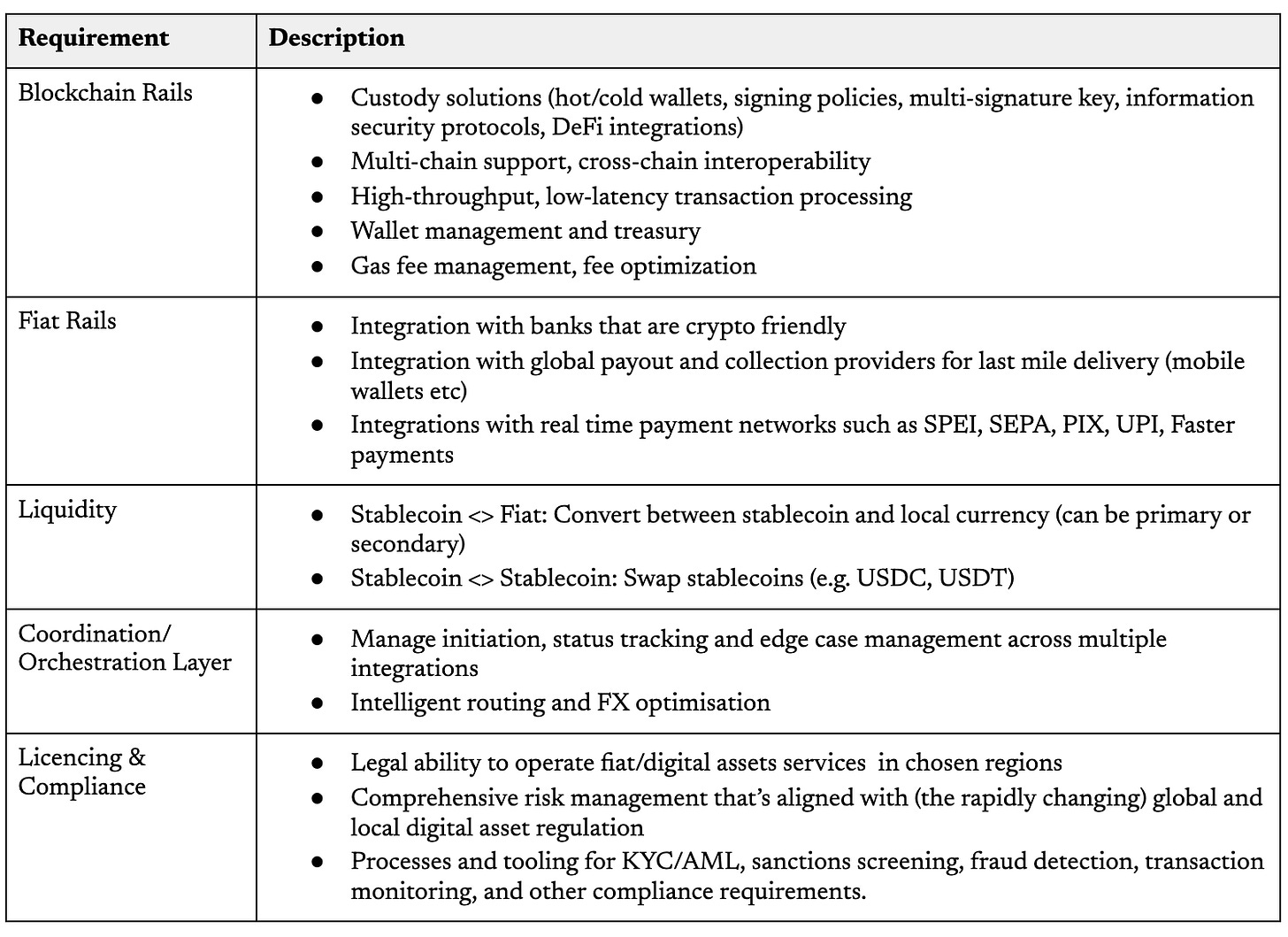

Step 2: Identify required capabilities

Key Questions

What’s in the stablecoin payment stack? What components/capabilities are needed?

What gaps do you have?

Where is there strategic fit with our existing infrastructure?

Entering the stablecoin market demands an extensive stack in addition to what existing fintechs already have. This includes the technology and expertise to:

support blockchain rails

support fiat rails

access and manage liquidity across asset types

coordinate transactions and

comply with digital asset regulations

See more detail in the table below:

Step 3: Understand the market landscape and identify the key players

Key Questions

Who does what?

What adoption/traction do they have?

What assets (tech, licences, expertise, customer relationships) do they have? How have they developed their expertise?

There are several market maps to guide you (the ones from Artemis and Archetype are the most extensive) and they categorize companies in slightly different ways.

For the purposes of this exercise I’ve categorized them around their job-to-be-done:

Step 4: Buy vs Build Analysis

Key Questions

How much experience and expertise do you have in house?

How quickly can you hire/acquire the expertise? How much expertise is out there?

How important is time to market for your strategy?

How much conviction do you have in the space?

What’s your track record of executing M&A successfully?

What are the acquisition costs and costs to integrate?

Following integration, how much would acquisition accelerate the roadmap?

Now that you’ve set the direction and identified your gaps, how do you fill them? When does acquisition make sense vs. internal development? The key questions above are a good way to get started but, depending on the fintech in question, arguably the most important aspect is talent/expertise.

Stablecoin expertise is scarce, concentrated among those who've iterated, experimented, and built solutions firsthand. M&A isn’t just about tech, it’s about acquiring the right people, insights, and battle-tested processes. Founders and fully formed teams may bring deep knowledge that’s hard to replicate.

Predicting the Next Wave of M&A

In the end, the question of strategic fit is nuanced and specific to the company in question due to their unique positioning in their market and comfort with innovating through blockchain. With that caveat aside, here are the sectors where I expect more M&A activity as they look to plug strategic gaps:

Payment Service Providers (PSPs) like Adyen, could look to enable stablecoin capabilities through orchestrators (e.g. BVNK).

Banks:

Will need custody technology to serve their clients (Fireblocks, dfns) or utilize custodians directly as a sub custodian (Anchorage).

We know they’re interested in issuing their own stablecoins so issuance technology might be a good fit (Brale, Paxos).

Banks dominate cross-border flows today and may decide to combine their strengths as FX liquidity providers with cross border orchestration platforms (e.g. Mural, Conduit, Nilos).

Cross-border payments companies (Thunes, Airwallex, Nium etc) may wish to expand the corridors through which they can do collections and payouts through acquisition of cross border orchestrators (e.g. Mural, Conduit, Nilos).

Merchant Acquirers may look to acquire capabilities to enable crypto payments in their gateways (Loop Crypto, Actalink).

Conclusion: Talent, Expertise & Speed to Market

Stablecoin payments aren't coming soon, they’re here. Your company's role in this ecosystem potentially hinges on swift, strategic action. Understanding and crafting your M&A strategy today is critical if time to market plays a key role in your positioning, especially given the lack of talent and expertise available.

What’s your strategy? Where do you see the next big moves happening?

PS: Thank you for reading to the end! I’d love your feedback, feel free to message me through my socials here.