Mobile Money to Global Money: Africa’s Stablecoin Revolution

How fintechs are turning stablecoins into critical financial infrastructure in Africa

1. The Quiet Revolution

“Stablecoins are already the present for cross‑border payments in Africa… the rest of the world is just catching up.” — Zekarias Amsalu, Co-Founder of Africa Fintech Summit

In recent weeks, Western fintech has woken up to the promise of stablecoins. Announcements from Stripe, Visa, Mastercard, PayPal, Ramp, and others have dominated headlines.

But while the West still debates what problems stablecoins actually solve, in emerging markets like Africa, the problems are clear, structural, and urgent. Stablecoins aren’t hype, they are essential infrastructure.

From remittances and retail savings to B2B trade and cross-border payouts, stablecoins are solving for dollar access, instant settlement, and FX inefficiencies in markets where traditional rails fall short. It's no surprise Africa is now the fastest-growing crypto region, up 45% YoY in 2024, with stablecoins accounting for the majority.

Africa is the world’s most dynamic growth market, with the fastest population growth, youngest median age, and nine of the twenty fastest-growing economies. With 400 million mobile money users, Africans have already embraced digital finance at scale. Stablecoins are the next leap, turning smartphones into globally connected dollar accounts.

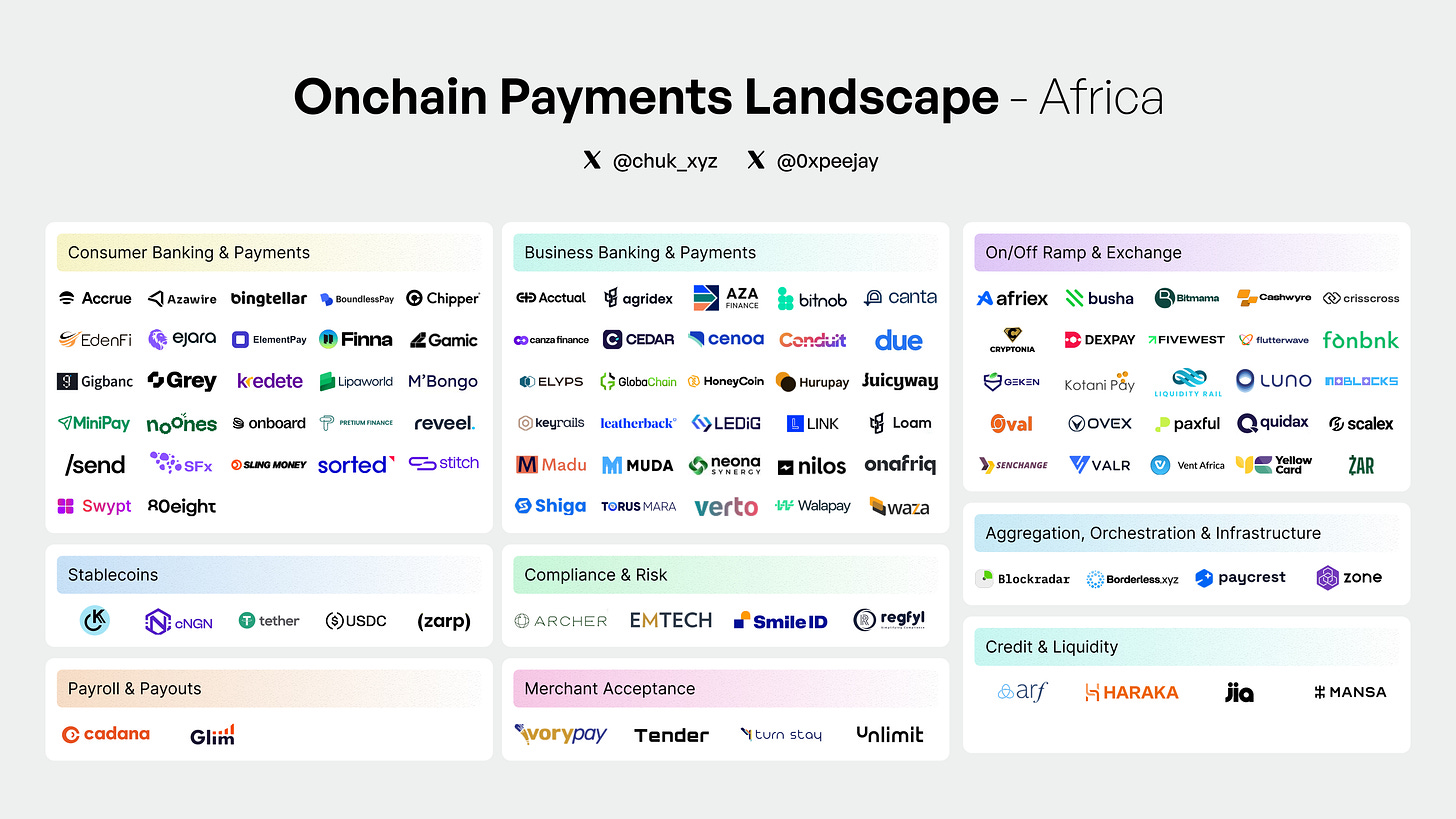

We mapped the ecosystem across corridors, use cases, and companies to show how deep this transformation runs. Plenty of market maps chart the stablecoin ecosystem globally, but few spotlight Africa’s role in shaping its future. So we built one to showcase the builders and use cases redefining financial infrastructure on the continent.

For the global fintech community, the question isn’t if stablecoins will go mainstream. The question is what we can learn from the places where they already have.

2. Stablecoins are solving everyday problems in Africa

“In Africa, it isn’t about stables vs. other financial tools. It is stables or nothing” — Samora Kariuki, Frontier Fintech

Across Africa, stablecoins are already solving real problems, from preserving value to powering trade flows. The adoption is driven by necessity, not trading and speculation. What follows are the most critical use cases, rooted in real demand, and the companies building rails to support them.

Everyday Tools: Saving, Spending, and Credit

In many African countries, inflation, currency devaluation, and limited access to banking services have made it difficult to build financial security. Stablecoins offer a more reliable path, serving as a dollar-denominated tool for savings, transactions, and credit.

Preserving Value: In Kenya, the shilling has lost 50% of its value against the dollar since 2021. In Nigeria, the naira has been devalued twice in 18 months. In much of Africa, USDT on Tron has become the de facto digital dollar. Most users access it via custodial apps like Binance, prioritizing speed and liquidity over Western concerns about reserves or transparency. For users dealing with FX rationing and 30% inflation, what matters most is that it works. Stablecoins help users preserve purchasing power and save in stable currency, right at the edges. With just 49% banked, but 400M using mobile money, stablecoins can meet users where banks don’t. Platforms like Fonbnk enable instant airtime-to-USDT swaps on basic phones, while Accrue provides agent networks for stablecoin cash-in and cash-out across local communities.

“By turning everyday prepaid payments—mobile data, bank transfers and mobile money—into USDT, Fonbnk acts as a stablecoin settlement layer, giving 400 million unbanked and underbanked Africans a hedge against currency devaluation and a new path to savings and credit beyond traditional banks.”

— Chris Duffus, Founder & CEO, Fonbnk

Expanding Access to Credit: Lack of banking results in an underdeveloped credit system for micro and small businesses. Platforms like Haraka use an innovative social credit system, while Jia taps decentralized finance to offer factoring, supply chain financing and other loans to businesses locked out of traditional finance, helping to close a $330B credit gap.

These tools give users more control over their money and unlock financial options previously out of reach.

Cross-Border Flows: Trade, Treasury, and Remittances

Cross-border payments power Africa’s daily economy, from importing goods and sending remittances to repatriating profits and paying freelancers. Yet the rails supporting these flows remain brittle: 3–5 day delays, 5–10% fees, and burdened by FX rationing.

Stablecoins flip that equation, compressing settlement to minutes, cutting costs to under 1%, and offering synthetic dollar access where banks can’t.

Trade and B2B Payments: China is Africa’s biggest trading partner, accounting for $176 billion in imports in 2023 and a $66.6B trade deficit. This creates constant demand for outbound dollar payments. Stablecoins are meeting this demand with speed and liquidity. USDT on Tron has become the preferred rail for many business payments due to its deep liquidity and wide exchange support.

“Stablecoins are the new primitive for cross-border payments in Africa. Businesses use Conduit to settle payments near instantly, lowering working capital, keeping their treasury liquid and avoiding currency volatility.” — Eric Wainaina, General Manager, Africa at Conduit

“Stablecoins have completely flipped the narrative for importers who couldn’t get dollars through banks—now their businesses are thriving.” — Suleiman Murunga, Director, MUDA

Remittances and Global Payouts: Just as stablecoins enable outbound payments, they are effective to bring money into the continent. That includes remittances, payroll, and freelance earnings.

“Sub-Saharan Africa remains the most expensive region in the world to send money, with average remittance costs hitting 8.37% in 2024. Yet many Africans abroad don’t realize they can now send money home using stablecoins, faster and at a very low cost.” — Xino Zee, Lead at Send Africa

A new class of companies is rebuilding Africa’s cross-border payment infrastructure around stablecoins. As exchanges, Yellow Card, Busha, VALR, and Luno provide liquidity for local on/off ramps. Conduit, Honeycoin, Shiga Digital, and Juicyway powering trade, collection and payouts for businesses, while Sling and Send power consumer P2P payments.

Together these teams move billions quietly. Many don’t sell “stablecoins”, they sell cheaper remittance, working capital efficiency, and currency stability.

3. Opportunities for builders

“In Africa you kick a tree and three stablecoin-powered fintechs fall out… the strongest teams we back now own a single corridor or industry flow—stablecoins are just the plumbing that disappears in the background.” Brenton Naicker, Principal & Head of Growth (Africa) at CV VC

The first wave of stablecoin growth focused on foundational infrastructure: on/off ramps, corridor liquidity, and basic wallet functionality. That layer is getting crowded fast. The next phase is about differentiation: who owns the user, defines standards, and captures margins in real-world use cases. Here are four levers shaping value creation across the continent.

Distribution: Win the User, Win the Flow

Control over user interfaces and customer relationships determines where volume flows. The strongest companies don’t lead with stablecoin infrastructure, they solve payments, lending, or treasury problems, with stablecoins embedded behind the scenes.

Liquidity: Control Both Ends of the Corridor

Local FX liquidity is uneven and hard to replicate. Teams that manage both origin and destination flows can offer better pricing, net transactions internally, and compress costs. Liquidity compounds, building a defensible moat.

Regulation: Shape the Rules While They're Still Forming

In crowded markets like Nigeria and Kenya, flawless execution is essential. But in underexplored markets like Malawi or Cape Verde, early movers have less competition and can work with regulators to define the playbook. Builders who invest in trust early may win long-term policy alignment. Big fish, small pond.

"US dollar liquidity, at scale , across most of Africa, is already on-chain via stablecoins. Policy makers should prioritize bringing local currencies on-chain at scale to accelerate economic sovereignty and trade” — Wale Ayeni, Managing Partner of Helios Digital Ventures

Verticals: Build for Specific Workflows

Each sector, whether it’s agriculture (see Agridex), logistics, education, or global aid, has its own workflows, user expectations, compliance quirks, and payment rhythms. Specialized builders speak the language, plug into existing tools, and solve what generalists can’t. Once trusted, they can layer on additional financial services like credit, treasury, or insurance. Focus builds stickiness, and margins.

4. Adoption Barriers to overcome

Despite strong traction, stablecoin infrastructure still faces structural challenges. To scale further, builders must navigate hard barriers, some technical, others political.

Policy Risk and Regulatory Fog

While there has been regulatory progress amongst the largest countries, most others still operate in a regulatory gray zone. Stablecoins are neither banned nor fully legalized, which slows enterprise adoption and deters institutional capital. As volumes grow, enforcement is likely to increase across capital controls, taxation, AML, and reporting. Progress here will come from proactive engagement with the regulators. Founders, trade groups, and regional sandboxes can help shape the rules.

“At Busha, we’re proud to be the first licensed exchange in this market, leading the charge with the liquidity, trust, and infrastructure needed to power a stablecoin-driven economy. This isn’t the future; it’s already here.” — Michael Adeyeri, Co-Founder & CEO of Busha

Currency Sovereignty

Governments are increasingly concerned that stablecoin wallets are creating a shadow dollar economy. Some countries are exploring local alternatives such as ZARP and cNGN, or piloting CBDCs to maintain monetary control.

“USD stablecoins’ dominance reflects a crisis of confidence... Without decisive policy innovation and encouragement of a regulated, competitive naira-backed stablecoin like cNGN, African countries risk ceding their financial control to offshore stablecoin issuers.” — Adedeji Owonibi, Founder & COO of Convexity (cNGN issuer)

Liquidity Gaps

Fast cross-border payments require capital to be available in the right place, currency, and moment. Providers like Wise and Thunes solve this with pre-funded accounts but with stablecoin flows, that responsibility shifts to market makers, OTC desks and other liquidity providers. As volumes grow, capital remains a constraint, corridor by corridor.

Payment Financing (PayFi) firms like MANSA and Arf are stepping in to fill the gap. By using stablecoins as a transport layer, they enable real-time liquidity for fintechs, orchestrators, and SMEs.

“Real-time, low-cost liquidity doesn’t just make payments faster—it unlocks entirely new models like just-in-time supplier finance. For founders who’ve always built around settlement risk, that’s a game-changer.

The next step is embedding this dollar liquidity directly into the apps and tools emerging market businesses already use—so that value can circulate as effortlessly as a WhatsApp message.” — Mouloukou Sanoh, CEO & Co-Founder, MANSA

Fraud, Scams, and Consumer Trust

Crypto adoption introduces new risks, from phishing scams and fake wallets to poorly secured apps. These vulnerabilities undermine trust, especially among first-time users. The burden of safety falls on consumer apps. Trusted design, risk tooling, and education must be part of the core product.

“Users are the biggest victims of malicious actors. And users only continue using and recommend the platforms that they feel are safe.” — Zach Bijesse, CEO & Co-Founder at Archer

Awareness and Education

Outside of crypto-native circles, many merchants and agents still find stablecoins opaque. Continued last-mile adoption depends on usability, training, and demonstrating real-world value.

“Awareness remains low in many rural and even urban communities, where crypto feels too technical.” — Xino Zee, Lead at Send Africa

These barriers are real, but they are being chipped away every day. The teams that succeed won’t wait for conditions to be perfect. They will build resilience, earn trust, and adapt across corridors and communities along with improving regulation.

5. What’s Next for Africa’s Stablecoin Ecosystem

Africa isn’t waiting for global consensus, it’s already building. Across remittances, trade, credit, and savings, real-world adoption is unfolding in real time. The demographics are in place, the demand is obvious, and as global regulation takes shape, this momentum will only accelerate.

This is where the future of programmable money is being prototyped. It’s a region to learn from, build with, and invest in.

We’re working on a documentary series to tell these stories - of the humans using stablecoins at the last mile - because for the stablecoin opportunity to be fully realized, we need to better understand the conditions that are driving and will continue to drive adoption of stablecoins in the markets where this technology has found product market fit. Justin Norman, Founder of The Flip

As Justin Norman of The Flip notes, understanding stablecoin adoption in Africa requires seeing the humans at the last mile, not just the technology.

The market map is just a snapshot, what matters most are the people driving the movement, and the lessons they hold.

If you’re building, investing, or exploring this space, I’d love to connect. And if you’d like to go deeper, I highly recommend exploring the articles and resources linked below.

This article reflects what I’ve learned as a curious student of the space from reading, listening and conversations with the builders, investors, and operators closest to the action. It’s a synthesis of those insights, and I’m keen to keep learning and connecting.

I’d like to express gratitude to the following individuals for generously sharing their insights and providing quotes that have been integrated into this article:

Adedeji Owonibi, Founder & COO of Convexity (cNGN issuer)

Brenton Naicker, Principal & Head of Growth (Africa) at CV VC

Chris Duffus, Founder & CEO, Fonbnk

Eric Wainaina, General Manager, Africa at Conduit

Ethen Eric, Founder at Send

Justin Norman, Founder of The Flip

Michael Adeyeri, Co-Founder & CEO of Busha

Mouloukou Sanoh, CEO & Co-Founder, MANSA

Suleiman Murunga, Director, MUDA

Wale Ayeni, Managing Partner of Helios Digital Ventures

Xino Zee, Lead at Send Africa

Zach Bijesse, CEO & Co-Founder at Archer

Zekarias Amsalu, Co-Founder of Africa Fintech Summit

Further Reading

The following long form pieces are great for diving deeper into the space: