Stablecoin Adoption Needs Understanding, Not Just Awareness

Awareness opens the door, but understanding unlocks progress.

Welcome to Stablecoin Blueprint, the weekly analysis about the opportunities and growth strategies in Stablecoin Payments and Onchain Finance

Got feedback or suggestions? Reply to this email or find my contact details online.

Two (short) notes today!

First, we launched a new podcast! Money Code is a new show I’m hosting with Raj Parekh (Head of Stablecoins and Payments at Monad and Co-Founder of Portal) in partnership with Stablecon and Powered by BVNK. Each episode we’ll dive into the details of building (and buying) in stablecoins and onchain finance.

Our first episode is live and we have an incredible guest in Simon Taylor, Author Fintech Brainfood and now GTM at Tempo. We get into his origin story, why he joined Tempo and the tradeoffs of building a payment chain for TradFi FI adoption. (scroll down for the embedded video).

In the first note of this week’s Stablecoin Blueprint, I describe why closing the knowledge gap between awareness and understanding is so critical and why we started Money Code.

In the second, I discuss the emerging trend in stablecoin remittances that I could lead to a major shift in where FX economics accrue.

Education: The Critical Lever in Stablecoin Adoption

It’s clear we’re at the beginning of a multi-year innovation cycle in payments, fintech, and financial services. Blockchain technology and tokenization promise faster, cheaper, more programmable systems, leading to greater efficiencies, more competition and ultimately better financial outcomes for end users.

The tailwinds are clear, but each is also a barrier because we are still early:

Regulation is clarifying, but fragmented globally and still being written.

Infrastructure is expanding, but remains a confusing patchwork of providers.

Liquidity is deepening, but uneven across corridors and still small relative to TradFi.

Awareness / Understanding is spreading, but shallow. More decision makers know stablecoins exist, but few grasp how they work, the risks, or the problems they actually solve.

Education is what turns awareness into real understanding.

Awareness opens the door, but to move beyond headlines or hype cycles we need buyers and users understanding enough to make real build-or-buy decisions. We need businesses and consumers knowing how to manage money in a new way without needing to become blockchain experts.

AI provides a useful contrast. Its benefits are tangible and easily demoed. Stablecoins are more abstract. Their benefits depend heavily on context: who you are, what markets you’re in, and what problems you’re trying to solve.

That makes education harder, but also more important.

The Collective Inefficiency

Talk to any builder in the space and you’ll hear the same story: lots of inbound, lots of interest, but the questions are basic and repetitive. Each potential partner asks the same things, over and over. No one wants to turn away that curiosity, but the collective inefficiency slows everyone down.

If we could raise the baseline level of understanding, across fintechs, corporates, and occasionally consumers, sales cycles would accelerate, partnerships would be more qualified, and adoption would move faster.

Ideally, stablecoins fade into the background. But when they are part of the value prop (e.g. paying remote workers who request that method) the end user (particularly businesses) often wants to know exactly what they’re getting into.

“Closing those knowledge gaps is the way you unlock progress inside a large organization.” - Simon Taylor

Inside large financial institutions, the challenge compounds. These organizations face challenging coordination problems. Dozens of teams, layers of approval, and processes designed to minimize risk. As Simon Taylor reminded us on our latest episode of Money Code, knowledge gaps are the bottleneck. Progress depends on patiently closing those gaps step by step, so that champions inside institutions have the confidence and political capital to push projects forward.

Why We Started Money Code

That’s the role of education and evangelization. It’s why we started Money Code.

For fintechs and financial institutions, our goal is to help them understand how stablecoins and onchain finance can actually benefit them: faster settlement, lower capital requirements, cheaper global expansion etc.

For builders, it’s to understand the real constraints incumbents face, so they can build solutions that work in practice.

My end goal isn’t to protect banks’ market share or to pick winners. It’s for end users (consumers and businesses) to benefit from more accessible financial services, greater competition, and better outcomes.

If banks adapt, great. If startups out-innovate them, also great.

Either way, education is the lever for adoption; and it’s the one most in my control.

See the full episode here:

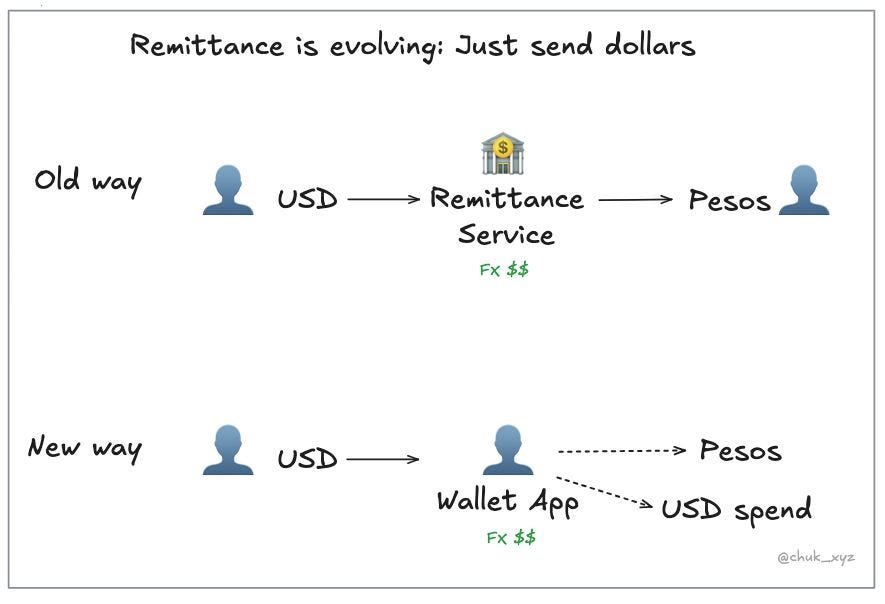

Remittance is evolving. And the biggest revenue line at stake is FX

As consumer wallet adoption grows, one remittance trend I'm seeing is to just send dollars directly.

Traditionally, US remitters send dollars, the service converts, and recipients are paid in local currency. After covering bills, many want to hold the rest in something stable, i.e. the dollar.

With stablecoins, you can just send dollars. Recipients decide when to convert, off-ramping as needed.

Benefits:

• Flexibility: convert at your leisure, you're in control

• Stability: USD as store of value

• Utility: can be used for US-denominated online services

This flips the model. Remittance is no longer fiat-to-fiat. It's just value transfer.

FX shifts downstream, into consumer apps.

That means billions in FX spread revenue could move from remittance firms to wallets and neobanks.

It's the Fat Wallet thesis but applied to remittances:

Wallet apps control the flow and capture the value, partnering with offramps as needed.

Defi trading fees makes up the majority of revenue for crypto wallets today.

FX could be a major line item for EM focused apps in a similar way.

The implications are big: capital flows, control, and who captures FX economics.

Thanks for reading!

Found this helpful? Let me know by clicking the like (🤍) icon and share it with someone who might find it helpful too.

Great thoughts here! Thanks for calling out the difference between “awareness” and “understanding”.

Not many people think about stuff like this.