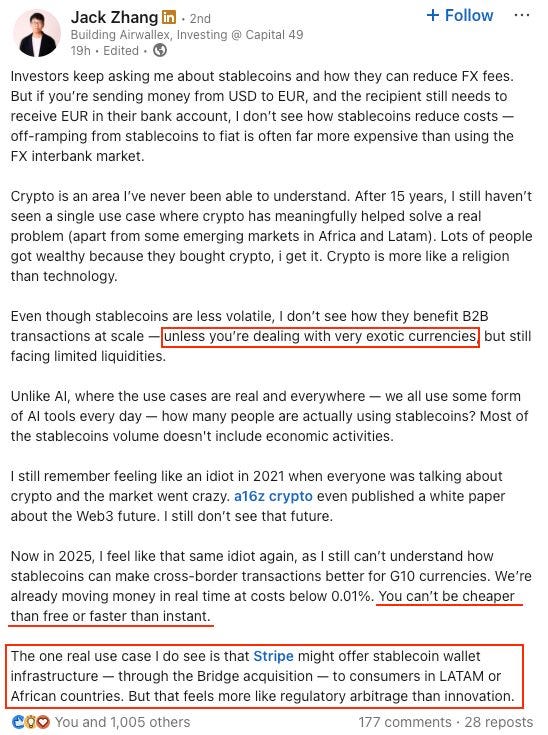

“You can’t be cheaper than free or faster than instant.”

That was Airwallex CEO Jack Zhang’s hot take on stablecoins over the weekend, questioning their relevance for G10 FX.

He’s right, for G10 corridors. But that’s not where the builder energy is.

Stablecoins aren’t about shaving basis points off already-optimized FX rails.

They’re about 𝐬𝐨𝐥𝐯𝐢𝐧𝐠 𝐫𝐞𝐚𝐥 𝐩𝐫𝐨𝐛𝐥𝐞𝐦𝐬 𝐢𝐧 𝐛𝐫𝐨𝐤𝐞𝐧 𝐨𝐫 𝐞𝐱𝐜𝐥𝐮𝐬𝐢𝐨𝐧𝐚𝐫𝐲 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐬𝐲𝐬𝐭𝐞𝐦𝐬:

• Permissionless dollar access in volatile currency environments

• Faster, cheaper settlement for exotic corridors (yes, liquidity remains a challenge)

• Rebuilding financial infrastructure at a fraction of today’s cost

Airwallex processes $130B APV after raising $1.2B over 10 years.

Stablecoin orchestrators are already at $36B+ APV, on far less capital and in far less time.

A strong signal that open infrastructure scales faster when it solves real pain.

𝐈𝐬 𝐢𝐭 𝐦𝐨𝐬𝐭𝐥𝐲 𝐫𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐚𝐫𝐛𝐢𝐭𝐫𝐚𝐠𝐞?

Yes, but so was Uber, Airbnb, and Neobanks in their early days.

Arbitrage isn’t a bug, it’s a wedge. It creates scale, unlocks network effects, and drives the innovation for the next wave.

In emerging markets, cross border payments still aren't free or instant.

Stablecoins fix the system where it’s broken.

Your regulatory arbitrage is their lifeline.