Stablecoins Will Not Save Western Union’s Past, but They Can Fund Its Future

PLUS: Wyoming and Metamask launch stablecoins

Welcome to Stablecoin Blueprint, the weekly deep dive into news, insights and opportunities in Stablecoin Payments and Onchain Finance.

Got feedback or suggestions? Reply to this email or find my contact details online.

In this week's Blueprint we cover:

🧐 Analysis: Stablecoins Will Not Save Western Union’s Past, but They Can Fund Its Future

📰 Top Stories:

Wyoming Becomes First State to Launch a Stablecoin

Fed Leaders Call for Balanced Innovation in Payments

MetaMask Announces Wallet-Native Stablecoin mUSD With Bridge & M0

📚 Recommended Reads:

Stablecoin Payments - The Trillion Dollar Opportunity by Keyrock and Bitso

Stablecoin Summer by Goldman Sachs Research

🧐 Analysis

Stablecoins Will Not Save Western Union’s Past, but They Can Fund Its Future

For a brief moment on July 22nd, it seemed like Western Union might be back. After the CEO mentioned a deeper push into stablecoins on a Bloomberg interview, shares of the legacy payments giant surged, closing the day up nearly 10% as investors rushed to buy the dip for the first time in years. The glimmer of hope, however, was short-lived. Just one week later, a dismal earnings report that missed analyst estimates (again) sent the stock back toward its lows, erasing the gains.

That flash of excitement wasn't just about Western Union; it was about Wall Street’s new favorite trade. In the wake of the landmark GENIUS Act and the stunning 5x run-up of stablecoin issuer Circle's stock, investors have developed an almost Pavlovian response: hear “stablecoins”, and buy. This clamor for exposure mistakes a buzzword for a business strategy. Stablecoins won't save Western Union's core business but they are the key to unlocking an entirely new future, if it makes the right moves.

The Decline of a Giant

The financial performance of Western Union, a titan founded in 1851, tells the story of a giant struggling in a new era. For years, Wall Street has treated the world's largest remittance company as a melting ice cube, and the numbers bear this out: since 2021, revenue has shrunk from over $5 billion to a projected $4.1 billion in 2025 as it loses market share to digital-first rivals. This decline is reflected in its share price, now hovering around $8-9 from a recent peak of $26 in 2021.

The foundational strength that built this 172-year-old titan, its unparalleled global network of almost 400,000 physical agent locations, has become its primary structural weakness. This agent-driven model is enormously expensive, comprising about 60% of WU's cost of services. This network exists to serve a vital customer: the migrant worker who often lacks access to banking and relies on cash. For decades, this was Western Union's moat.

Today, however, that cash-dependent segment is in long-term structural decline as the world digitizes. Meanwhile, on the digital front where the future lies, WU’s performance is starkly different from its competitors. While Western Union’s branded digital revenue grew a modest 6% in the last quarter, rivals like Wise and Remitly have been posting growth rates of 20-30% or more. Once the undisputed king of remittances, Western Union is now fighting a losing battle on its competitors' digital turf.

The Seductive, but Flawed, Solution

On the surface, Western Union’s plan for stablecoins appears comprehensive. In its recent earnings call, the company outlined a four-pronged strategy:

improving its own treasury operations;

enabling global payments with stablecoins;

offering buy/sell/hold capabilities in its digital wallets; and, most crucially,

making its network available as a global on- and off-ramp for the crypto ecosystem.

However, the company’s immediate focus and, in the CEO’s words, “where we’re spending most of our time and energy“, have centered on the first pillar: using stablecoins to fix its own back-office inefficiencies.

The appeal of this approach is undeniable. CEO Devin McGranahan highlighted how stablecoins could "significantly increase settlement speed and reduce the amount of pre-funding required by our partners." He highlighted a recent weekend liquidity crunch in India that delayed payments. Stablecoins "could’ve topped up in real time, 24/7," dramatically improving service.

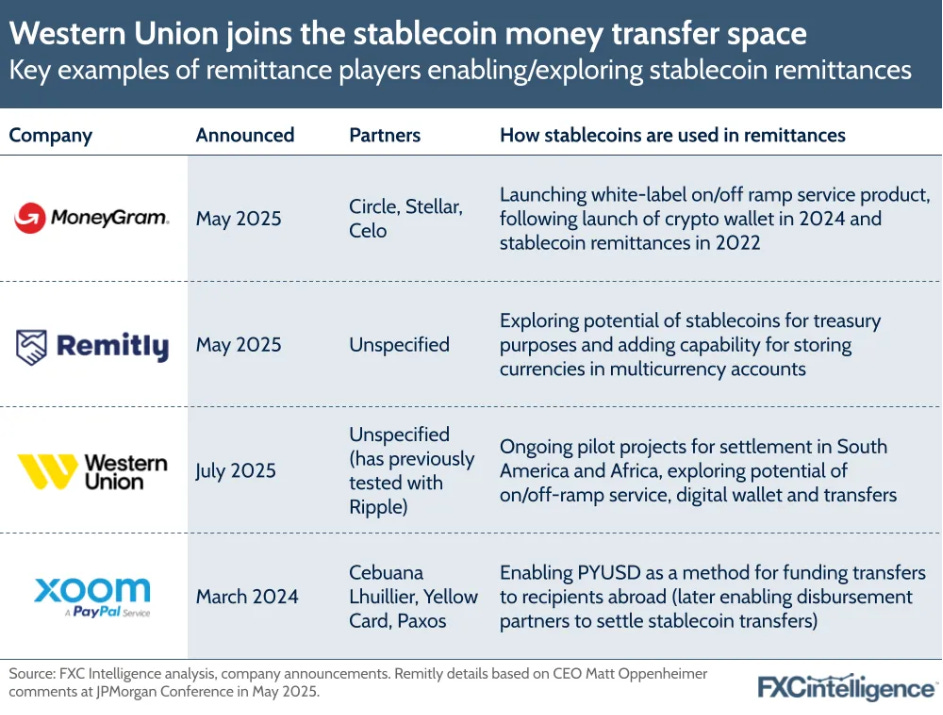

But while a more efficient treasury is a sensible goal, it offers no long-term competitive advantage. Key rivals like MoneyGram and Remitly are already pursuing the exact same stablecoin-based settlement strategies. Any cost savings Western Union realizes will almost certainly be competed away in a bid to keep pace with digital players who have a lower cost structure to begin with. This turns a potential innovation into a simple cost-of-doing-business, doing nothing to reverse the company's structural decline.

The Real Opportunity: The Cash Bridge to the Digital Economy

The future for Western Union won’t be secured by chasing its digital competitors on their own turf, but to become the one thing they cannot be: the world's primary cash-to-stablecoin access layer. The company should lean into its 400,000 physical agent locations as its most vital strategic asset. By doubling down on this network and its highly-trusted brand, Western Union can solve a critical piece of financial infrastructure: providing a seamless on-ramp and off-ramp between physical cash and the global digital economy, a service desperately needed in many emerging markets.

This strategic pivot can be executed through a two-pronged approach. First, through first-party flows, Western Union can integrate cash-to-stablecoin conversion directly into its own highly-rated mobile app. A user could walk into a trusted Western Union agent, hand over volatile local currency, and have US dollar stablecoins appear in their digital wallet moments later. This is a powerful proposition for those with volatile currencies who want to save in dollars to protect their wealth.

The second, and more powerful, approach is through platform flows. Western Union could expose its agent network via an API, allowing third-party wallets and fintechs to embed a “Pay with” or "Cash Out with Western Union" button directly into their applications. The demand for this is already apparent; McGranahan admitted on the company's earnings call that they have been "pleasantly surprised by the volume of inbound interest for on- and off-ramp services." This transforms Western Union from a closed-loop remittance service into open infrastructure. The essential "last mile" for a rapidly growing digital ecosystem that still needs to touch the physical world.

The financial payoff for on/off ramps alone could be substantial. Using current take rates and agent economics (given their pricing power for cash based transaction), just $10 billion in on- and off-ramp volume could generate an estimated $80 million in operating profit, a material addition to the company's roughly $800 million total today. To put that volume in perspective, digital competitor Remitly added $5 billion in send volume in the most recent quarter, relative to last year.

Beyond the transaction fees, having a wedge to a Western Union digital wallet provides an opportunity to deliver more financial services such as a debit card for spending online, credit, and saving and investing products. Western Union are considering issuing their own stablecoin, their digital wallet and extensive cash on/off ramp network would be a compelling offering and convenient distribution channel. Crucially, unlike Western consumers, the recipients of this offering would be less rate sensitive, potentially allowing Western Union to retain more of the yield.

These new capabilities would fundamentally redefine the role of a Western Union agent. The agent counter is no longer just a place to pick up a one-time transfer. It becomes an effective bank branch for the digital age. For the millions of unbanked or underbanked people Western Union serves, their local agent becomes the physical bridge to a global digital wallet, finally fulfilling the promise of banking the unbanked.

A Necessary Pivot, Fraught with Risk

This strategic pivot is fraught with challenges, from the immense execution risk for a 172-year-old company to the long-term decline of cash and the threat of informal P2P networks. However, the structural decline of its core business is precisely why this pivot is so necessary.

While Western Union must continue to defend its legacy business, the on/off-ramp strategy provides a desperately needed engine for new growth. It gives the company more exposure to the rapidly expanding digital asset economy, where its global physical footprint provides a powerful and durable differentiator, buying crucial time to become the indispensable cash bridge to the future, if it can execute.

Western Union’s recently announced $500M acquisition of cash-centric Latam-focused remittance player Intermex, suggests they feel more comfortable squeezing synergies out of declining businesses and converting cheaply acquired users to digital. Acquisitions are a huge drain on time and focus, and is yet another risk that could inhibit Western Union’s transformation. However, the additional retail locations can be a strategic asset, in keeping with their potential new role as the cash bridge of the future.

Conclusion

The future for Western Union won’t be secured by using new technology to marginally improve its old business model. The strategic choice is now stark: continue a defensive fight against digital-first players on their terms, or pivot to become the indispensable cash bridge connecting the physical world to the burgeoning digital asset economy. Stablecoins do not rescue yesterday’s remittance economics, but they are the key to unlocking tomorrow’s platform economics. One path leads to a managed decline; the other, to a new reason to exist.

📰 Top Stories This Week

Wyoming Becomes First State to Launch a Stablecoin

Wyoming officially launched the Frontier Stable Token (FRNT), the first state-issued stablecoin in the U.S. FRNT is backed by dollars and short-term Treasuries, with a mandate for 2% overcollateralization. The token went live on seven blockchains (Ethereum, Solana, Arbitrum, Avalanche, Polygon, Optimism, Base) via LayerZero. Reserves are managed by Franklin Advisers, with audits from The Network Firm. Wyoming-domiciled crypto-exchange Kraken and Rain will be among the first platforms to distribute FRNT. The move comes one month after the GENIUS Act established a federal stablecoin framework, though state issuers may fall outside its oversight.

Why it matters:

This is a historic move that demonstrates Wyoming’s regulatory innovation ability, regardless of whether the token is adopted or not.

Demonstrated capability: Launching FRNT shows state-level competence across issuance, reserves, audits, and multi-chain ops, reinforcing 45+ digital-asset laws since 2016.

Signaling effect: The Frontier brand and public launch signal industry collaboration and may draw issuers, custodians, and developers to domicile in Wyoming.

Adoption challenge: There doesn’t appear to be a compelling use case for a state issued stablecoin. However given their stature it’s not hard to imagine how they might try to incentivize adoption though partnerships with PSPs, tax collection, and government disbursements.

Fragmentation risk: Adds another brand to a crowded field, increasing choice paralysis. State-issued tokens compete on different trust terms. Nebraska and Texas are exploring similar moves, more state launches could deepen confusion.

Regulation is the product:

Adoption may be uncertain, but that is not the point. Wyoming has converted policy leadership into operational proof. FRNT is a capability demo that strengthens its role as regulator and industry partner. By demonstrating competence in issuance, reserves, and audits, the state cements its position as a forward-thinking regulator, which in turn helps attract digital asset businesses to Wyoming.

Fed Leaders Call for Balanced Innovation in Payments

At the Wyoming Blockchain Symposium, Fed Governor Christopher Waller and Vice Chair for Supervision Michelle W. Bowman delivered back-to-back speeches on payments innovation. Waller emphasized private sector leadership in stablecoins and AI, with the Fed focused on providing infrastructure and regulatory clarity. Bowman warned that excessive caution could sideline banks and U.S. competitiveness and urged regulators to shift from a defensive posture toward innovation to a constructive, principled framework.

Why it matters:

The Fed is signaling openness to digital asset innovation while underscoring guardrails. For fintech and banks, this marks a shift in tone from defensive skepticism to active engagement.

Private sector should lead: Most progress in wallets, stablecoins, and AI comes from firms, with the Fed focusing on core rails and standards.

Modernize supervision, not block it: End “reputational risk,” sunset novel supervision, and apply tailored, risk-based expectations so banks can serve legal digital-asset businesses.

Tokenize real-world assets to fix settlement frictions: Use tokenization to transfer title faster and cheaper, improving wholesale and international payments as legal frameworks align.

Use AI aggressively in payments operations: Expand beyond fraud detection to reconciliation, compliance, and risk management as agentic systems mature.

Deepen Fed–industry engagement: The Fed will research tokenization, smart contracts, and AI, and seek closer dialogue to align public infrastructure with private innovation.

Bottom line: The Fed signals pragmatic openness to digital asset innovation. Waller and Bowman place stablecoins, tokenization, and AI in a private sector-led model, with the Fed modernizing core rails and tailoring supervision. With the GENIUS Act live and “reputational risk” removed from exams, banks have clearer paths to participate without guesswork.

MetaMask Announces Wallet-Native Stablecoin mUSD With Bridge & M0

MetaMask unveiled MetaMask USD (mUSD), a dollar-backed stablecoin issued by Stripe-owned Bridge with onchain infrastructure from M0. The token is slated to launch later this year on Ethereum and their L2 chain Linea, with a linked Mastercard card being available by end of year . MetaMask says it will integrate mUSD across on-ramps, swaps, bridging, and DeFi, leveraging its millions of users.

Why it matters:

A wallet-native dollar becomes the default rail inside one of crypto’s largest distribution channels.

Distribution capture: MetaMask has millions of users (30M MAU as of 2024) that it can influence to use its stablecoin in a number of ways. Direct onramps have high potential as they can be a much better alternative than going through an exchange or paying sometimes 2-3% with an onramp service.

New issuer stack: Bridge handles licensing and reserves, M0 provides interoperability and liquidity, a new pattern for “app-specific” stablecoins.

Spendable savings: Card acceptance at Mastercard merchants converts self-custody balances into real-world spend. This has become table stakes for consumer wallets.

Market impact: Raises competitive pressure on existing stables for default placement in wallets, however it’ll take time for any new stablecoin to match the utility and availability in DeFi and exchanges of the incumbents.

Distribution will be monetized

This shouldn’t come as a surprise to anyone following the space over the past year. Stablecoins enable companies to better monetize their distribution and the MetaMask wallet is a powerful touch point. Combine stablecoin linked cards, yield and defi and you have a powerful non-custodial onchain bank in the making. I wouldn’t be surprised to see other popular wallets follow the same path

Notably, earning yield directly from the stablecoin wasn’t mentioned in their announcement, possibly due to GENIUS prohibitions, but I’d expect them to enable passive savings soon, possibly via a workaround or through their earn products. Without that, I think enticing existing users to switch will be challenging.There are still several levers they can pull (e.g. discounted swap fees, free onramps), but in a closed system, yield is the ultimate differentiator, and outside of that system, fighting for dominance in DeFi anywhere outside of their own chain Linea will be a tough uphill battle.

📚 Recommended Reads

In Stablecoin Payments - The Trillion Dollar Opportunity, Keyrock and Bitso provide a market outlook that forecasts stablecoins processing over $1 trillion annually by decade’s end, highlighting FX settlement, cross-border flows, and institutional adoption as growth drivers.

In The Money Layer: LATAM Crypto 2025 Report, Dune provides a data-driven research report that maps how exchanges, stablecoins, on-/off-ramps, and payment apps enable practical crypto use across Latin America.

In Stablecoin Summer, Allison Nathan of Goldman Sachs Research, combines interviews with Brian Brooks, academic experts and in-house research to assess the market outlook for stablecoins, their commercial models, and potential impacts on Treasuries, payment rails, and bank deposits.

Thanks for reading!

Found this helpful? Let me know by clicking the like (🤍) icon and share it with someone who might find it helpful too.