Stripe and Circle are launching L1 blockchains

The Great Chain Debate

Welcome to Stablecoin Blueprint, the weekly deep dive into news, insights and opportunities in Stablecoin Payments and Onchain Finance.

Got feedback or suggestions? Reply to this email or find my contact details online.

Why Own the Rails? Follow the Incentives

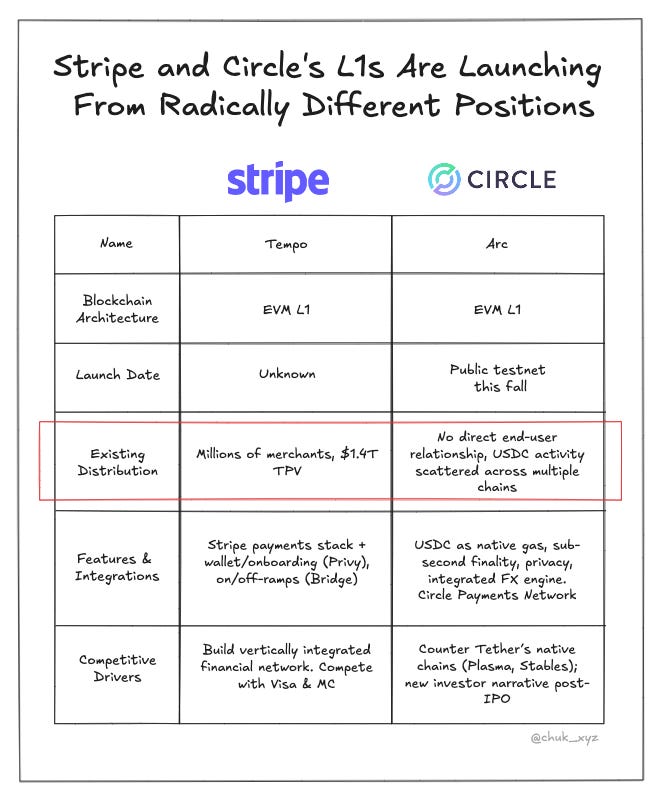

Within 24 hours, plans to launch new Layer 1 blockchains from both Stripe and Circle were made public. This kicked off a storm in stablecoin and crypto circles. In crypto, the loudest debates are often about ideology — decentralization, shared infrastructure, permissionless access. When big companies commit real capital, the driver is almost always the same: control over distribution, economics, and the user experience. But not all companies start from the same position. Companies that already own distribution and control transaction flows start with a decisive advantage in making a new chain succeed.

The Rise of Company Backed Chains

Stripe and Circle are the newest entrants in a growing wave of company-backed blockchains.

Some, like Coinbase’s Base, Kraken’s Ink, OKX’s X-Layer, and Robinhood’s upcoming chain, are general-purpose networks for their consumer ecosystems.

Others, such as Tether-backed Plasma and Stables, Circle-backed Arc and Codex, and Securitize & Ethena-affiliated Converge, are purpose-built (or purpose-configured) for stablecoins, payments, and onchain finance.

The common thread: a corporate sponsor with a captive audience and a clear commercial goal. To serve those users more directly and capture a larger share of the value they generate.

Why Build Your Own Chain?

At its core, the decision comes down to incentives.

Value Capture – Running the base layer means owning the entire vertical stack and keeping more of the economics: transaction fees, MEV, network effects and potentially the upside from a native token.

Control – Align governance, upgrade path, and compliance with your needs while avoiding congestion from unrelated activity.

Purpose-Built UX – Generalized chains can’t optimize for every use case. A purpose built chain can choose block times, privacy options, and gas models specifically for payments and finance use cases.

For payment focused chains this is the app-chain thesis: specialized blockchains can deliver better UX for targeted use cases and let their sponsors control both the product and the economics.

The challenge is bootstrapping.

Owning a chain is one thing; getting people to use it is another. Without an existing user base, attracting liquidity, developers, and activity is an uphill battle. This “cold start” problem is why smaller developers and applications often choose to launch on thriving, established ecosystems.

Large companies with direct access to users can bypass much of this challenge. By moving existing activity on-chain and handling the complexity behind the scenes, they can create a functioning economy from day one without forcing customers to adopt new tools.

Why L1 Over L2?

Why not launch as a Layer-2 on Ethereum? An L1 avoids dependency on another ecosystem’s technical and governance decisions, this additional control and configurability can enable greater optimization for your specific use case. An L1 also makes it easier to control the economics of a native token, which can be valuable both strategically and financially. The tradeoff is that L2s are typically faster to launch and easier to manage out of the box. For payments use cases, more control over consensus mechanisms, privacy and governance likely pushed Stripe and Circle over the edge.

The Stablecoin Payments and Onchain Finance Gap

A subset of the new wave of chains is converging on a similar opportunity: the lack of a stablecoin- and payments-optimized blockchain. Tether-backed Plasma and Stables are USDT-focused. Circle-backed Arc and Codex are USDC-centric. 1Money Network is independent. Stripe hasn’t announced which stablecoin it will use, but it’s likely to issue its own stablecoin given its Bridge acquisition. The shared features, faster finality, stablecoin gas, optional privacy, target user needs that aren’t well served by general-purpose chains.

While these companies see the gap, their ability to fill it is not equal.

Stripe owns the flow: millions of merchants, licensed on/off-ramps, and wallet tech from acquisitions like Bridge and Privy. It can push transactions on-chain without users even realizing, solving the bootstrapping problem instantly and giving Stripe an adoption edge few can match

Circle, as USDC issuer, doesn’t own its end users by design. USDC is distributed through partners like Coinbase, and activity is scattered across chains. Arc offers strong tech, speed, privacy, native USDC, but without built-in distribution, adoption will require persuading others to move. Circle's recently launched Circle Payments Network and wallet infrastructure offerings are good distribution channels, but they are yet to reach broad adoption.

Tether-backed chains Plasma and Stables face a similar challenge and will need to persuade others to move. Plasma is making steady progress solving the cold start problem, capturing $1B of liquidity from potential users and bolstering its warchest with $373M from token sales, however both chains face an uphill battle. Today, 40% of all blockchain fees are paid to send USDT, and most of that is captured by Tron. Moving to lower cost chains would greatly reduce the fees generated, and the fee capture that remains would be more aligned with the Tether ecosystem.

Stripe is playing offense, turning its existing network into an onchain economy. Circle and Tether are playing defense, building dedicated rails to lock in and capture more of the value their stablecoins already generate.

Ideology vs Incentives

The contrasting positions of Stripe and Circle have reignited a broader debate on company-backed chains.

The ideological camp argues that each new L1 fragments liquidity, weakens interoperability, and recreates a world where every company runs its own siloed protocol. Liquidity concerns are especially acute for stablecoins and payments, where fragmented pools can limit utility and increase costs. Corporate pragmatists counter that these companies are free to experiment and competition will reveal what works. This is good for the ecosystem, especially if they bring net new users on chain.

The real divide isn’t company-backed vs community chains, or even L1 vs L2, but ideology vs incentives. The market will reward whichever model delivers the most utility to users, not the one that best fits a philosophical ideal.

Bottom Line

The “Great Chain Debate” is less about technology than about power. Every company-backed blockchain is a bet that controlling the base layer yields better economics, product fit, and value capture than building on someone else’s rails.

In the end, this wave of corporate chains is a test of whether distribution and incentives can outweigh ideology and network effects. Some will thrive by converting existing users into on-chain activity; others will struggle to persuade anyone to move. It will be a messy contest decided by adoption, not principle, and control over the users is the ultimate advantage.

Really insightful!!

Good stuff Chuk!