What Matters in a Blockchain, Anyway?

Do your users see permissionlessness as a feature or a bug?

Welcome to Stablecoin Blueprint, the weekly analysis about the opportunities and growth strategies in Stablecoin Payments and Onchain Finance.

Got feedback or suggestions? Reply to this email or find my contact details online.

The Great Divide

This week, renewed buzz around Google Cloud's Universal Ledger, sparked by a viral LinkedIn post, brought the permissionless vs permissioned debate back to life. (For details on what GCUL is, see this post). Is this the mass adoption we’ve been waiting for, or a sterilized, corporate version of the future that betrays crypto’s core principles? The gut reaction is to see it as a battle for the soul of the industry: the open, permissionless ideal versus the closed, walled garden.

The most interesting question to me isn't whether GCUL will eat Ethereum’s lunch, or even whether it’s a "real" blockchain. It's understanding why it was built this way.

GCUL is a public display of designing for a specific customer, built on the calculated bet that for banks and financial institutions, the core properties we celebrate (openness, permissionlessness) are not features to be desired, but bugs to be engineered away in favor of control and compliance.

What matters in a blockchain anyway?

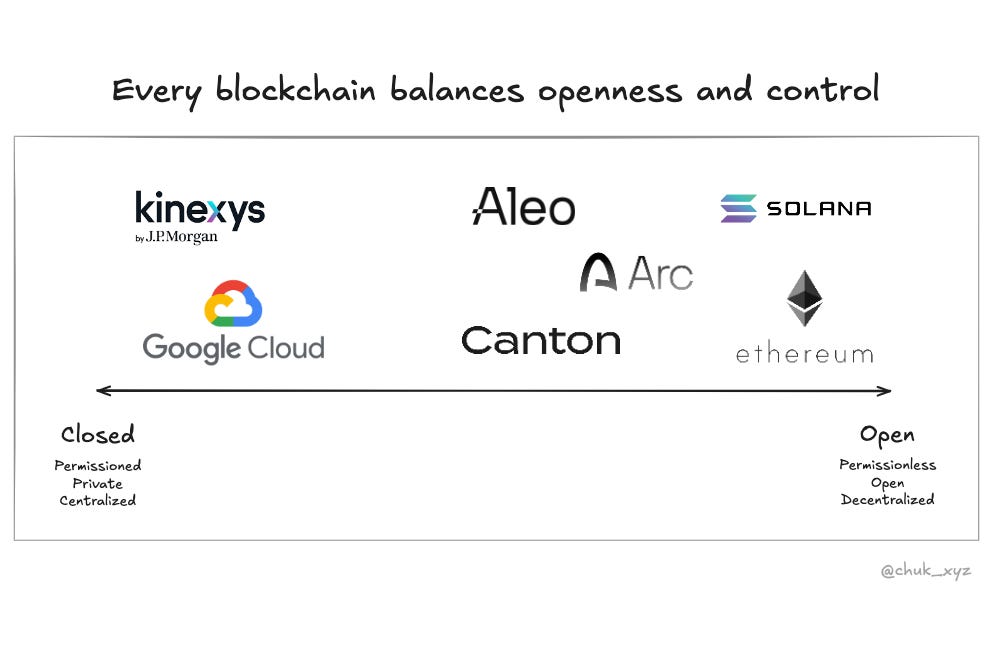

To understand this split, we have to stop treating "blockchain" as a single concept. Instead, I think of every network as a series of design choices across a couple of fundamental levers: the 'who,' the 'how,' and the 'what.'

First, who can access the network? Is it a public park open to all (permissionless), or a private club with a guest list (permissioned)?

Second, how is truth determined? Is it by a neutral, decentralized crowd, which gives us censorship resistance, or by a central operator who offers efficiency and accountability? How easy is it to become a validator? There’s typically a tradeoff of decentralization and performance here.

Thirdly, what can people see? Is the ledger's data transparent to all participants? Or are transaction details sealed and kept private?

An open network like Ethereum pushes these levers toward maximum openness, while private ledgers like GCUL and JP Morgan’s Kinexys pull them in the opposite direction to maximize control and minimize liability. These archetypes are just the poles of a wide spectrum. Networks like Aleo and Canton are already exploring the middle ground by combining permissionless access with tools for private transactions, proving these design choices aren't all-or-nothing. There’s lots of innovation to come from mixing the levers.

The Open Rails: Optimizing for a Cambrian Explosion

Networks like Ethereum push all three levers toward maximum openness: permissionless access, decentralized consensus, and a public ledger. This results in maximum participation and composability which leads to explosive, unpredictable innovation.

By allowing anyone to participate in the "money LEGOs", you get a compounding effect where new financial products can be created rapidly. This is the Cambrian explosion of DeFi. But from the perspective of a bank's compliance officer, this openness is a compliance nightmare. The lack of a gatekeeper, the anonymous actors, and the regulatory ambiguity are risks to be minimized.

The Walled Garden: Optimizing for Control

On the other hand, GCUL / Kinexys pull all three levers in the opposite direction for one primary reason: control. Access is permissioned to vetted participants, consensus is centrally managed for accountability, and transaction data is kept private to protect business and client data.

This architecture is optimizing for managed liability. Permissionlessness is a bug. The killer feature is knowing exactly who is on your network, controlling governance and having a clear process for recourse if things go wrong. The bet these giants are making is that for their institutional clients, this regulatory comfort and ease of integration is far more valuable than the innovative, chaotic potential of the open rails. They’re selling a solution to a compliance problem.

The Strategic Gamble: Distribution vs. Disruption

This sets the stage for a classic strategic gamble playing out in real time: Distribution vs. Disruption.

On one side, the incumbents are betting on their massive distribution. They believe their existing client relationships and trusted brands can bootstrap their chains and create a powerful moat. By offering a compliant, "good enough" solution that’s easy to adopt, their goal is to win by onboarding trillions in assets through sheer scale, making their ecosystem the center of gravity.

On the other side, the crypto-native world is betting on disruption. The belief here is that the products and networks built on open rails will eventually become so superior (faster, cheaper, automated, personalized) that they can overcome the distribution moats created by the large corporate players.

The risk for institutions is immense: by choosing the safe, walled garden today, they are betting they won't be made obsolete tomorrow by a more dynamic ecosystem. While this 'baby steps' approach may be the only path their risk officers will approve, it strategically leaves the door wide open for the disruptors.

Competition, Not Conquest, Is the Victory

So, who wins this high-stakes battle? In the end, it’s likely end users.

Competition itself is a victory. The explosive growth of open finance lit a fire under the legacy system, forcing an entire industry to innovate. In turn, the move by institutions to adopt tokenization (even if in walled gardens initially) validates the underlying technology at a massive scale, normalizing it for the entire world. This competition results in cheaper global remittances and more accessible financial products even for users using legacy systems.

The pragmatic reality is that the near future is a multiverse of interconnected networks, each optimized for its purpose. For us as builders the challenge is to stop asking "which chain will win?" and start asking "which trade-offs best serve my user?"

Thanks for reading!

Found this helpful? Let me know by clicking the like (🤍) icon and share it with someone who might find it helpful too.